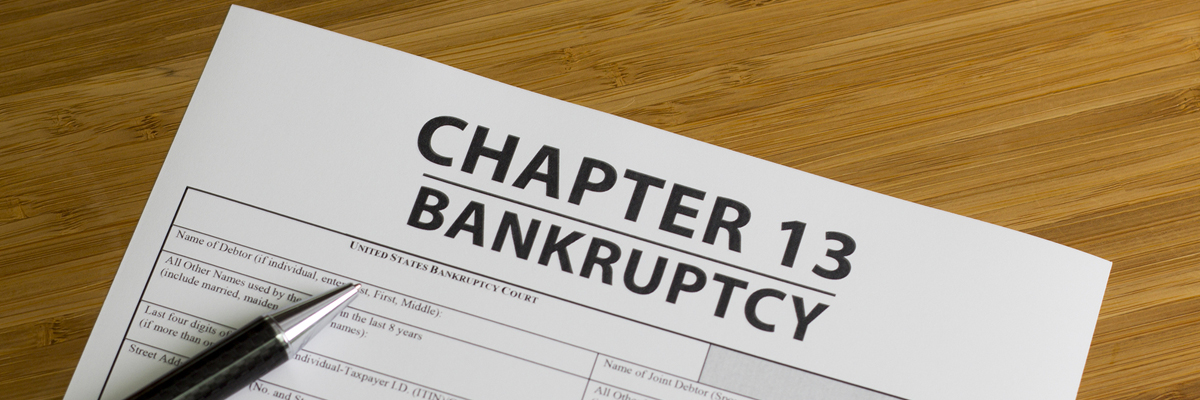

Role of your Chapter 13 Bankruptcy Trustee

When a Chapter 13 bankruptcy is filed, the debts are generally reorganized and repaid within five years. The creditors receive the dues over a three to a five-year term and the administration of this plan is monitored by an appointed trustee, exclusively for Chapter 13 filings. Here is a brief list of the bankruptcy trustee’s duties with regards to Chapter 13 bankruptcy filing – Reviewing all associated paperwork of the filing Reviewing of the repayment plan for its compliance to bankruptcy laws Collecting the payments as per the plan and distributing the same to the creditors Executing the [...]