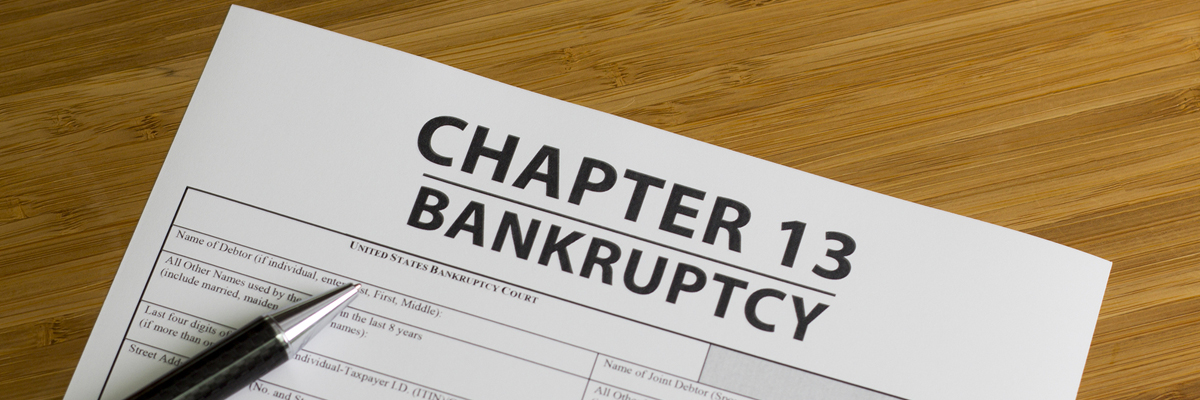

Debts That Can Be Cleared With Chapter 7 Bankruptcy

The main benefit of filing for bankruptcy using Chapter 7 is to be relieved of existing debts. Also known as liquidation bankruptcy, Chapter 7 provides the means to get the debts discharged. Here are the debts that can be cleared using Chapter 7 Store cards overdraft of checking accounts Credit cards Certain tax debts Personal Loans Parking tickets Social Security and unemployment related overpayments Medical bills (inclusive of dental) During a Chapter 7 bankruptcy case, the trustee is entitled to take the control and possession of any property that is not exempt. Hence the debtor needs to understand the asset types that can be exempted in a [...]