Call: 888-297-6203

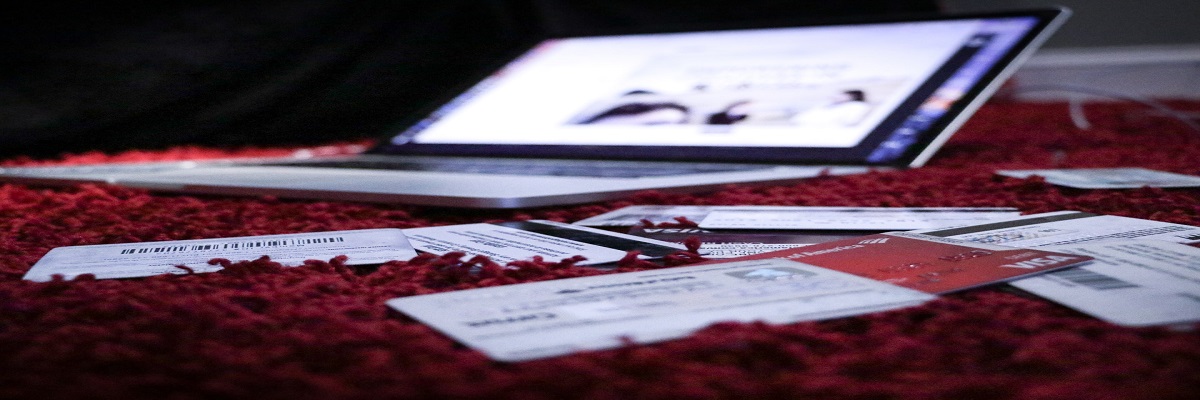

Bankruptcy has a major impact on credit score, and it is obvious to hit the credit score of an individual by over 100 points at least. The credit score works on a factor that indicates an overall risk to the lender and the lower the credit score larger the risk for the lender. Once any person has declared bankruptcy, it is very difficult for a lender to trust or provide credit for such a person so easily. Such people might not be able to avail of any unsecured loan for several years, sometimes even up to 10 years.

Need for planning

However, bankruptcy under Chapter 7 in certain circumstances may lead to short-term consequences on the credit score. The planning to analyze how much credit score damage the overall bankruptcy could cause and whether it is advisable to go on such a road that could potentially leave scars for several years needs expert supervision. https://recoverylawgroup.com/bankruptcy/ is one of the best available support systems that can provide the right advice at the right price in and around Los Angeles and Dallas, TX. It is important to note that no matter what chapter is used, it takes a significant amount of time and effort to gain a credit score and the trust of lenders once the bankruptcy is declared. It surely cannot happen overnight!

Understanding the factors resulting in tarnishing credit score

It might seem very relieving and helpful to get rid of all credit card debt and any other unsecured debt on your plate while applying for bankruptcy, but the fact is the amount of debt that is defaulted or released after bankruptcy tends to impact credit score directly. For instance, if a borrower has applied for bankruptcy and he had very few unsecured debts and ended up releasing only say $10k of debts during the bankruptcy, considering other factors remain normal or consistent, his credit score might be impacted by less than 50 points.

However, in another scenario, if a borrower manages to release say $200k of total debt after bankruptcy, he might end up losing 200+ points as well. In each scenario, the credit score before the bankruptcy filing is the key to determining the impact of bankruptcy. A high credit score before bankruptcy will certainly take a huge hit. While a person with a very low score might see a boost of a few points after bankruptcy.

Some suggestions to improve creditworthiness

- The first and foremost suggestion would be to manage finances well and avoid any kind of debt until you have your finances in order.

- For any bills like the electricity bill or any other debt payments-especially, if you must pay EMIs as per your chapter 13 plan, it is best to never default and pay it a few days in advance. Scampering on the last day or paying one day after the due date does not impress lenders.

- Once, you are at pace with your finances and you feel you can manage them well, monitor your credit score regularly and avail of smaller credit facilities when available. If unsecured credit is availed and repaid on a timely basis for a few years, it has a significant positive impact on creditworthiness. However, it is important to stay underutilized and not splurge the limit excessively as it does not help

- Do not pre-close any loans on shorter notice. Having loan accounts and paying EMIs on time for say 2-3 years has a positive impact on the credit score. You can also look for reasonable credit builder loans that are typically for 2-3 years.

If you need more such suggestions ideas or solutions for your bankruptcy problems, dial 888-297-6203 now.